In the U.S., consumer spending was back up to pre-pandemic levels in September 2021. This is what Sea-Intelligence has confirmed by analyzing data published by the Bureau of Economic Analysis (BEA).

Commodity spending continues to exceed expenditure on services. Consumption of non-durable goods is increasing the most. By contrast, spending on durable goods has been steadily declining since the beginning of 2021.

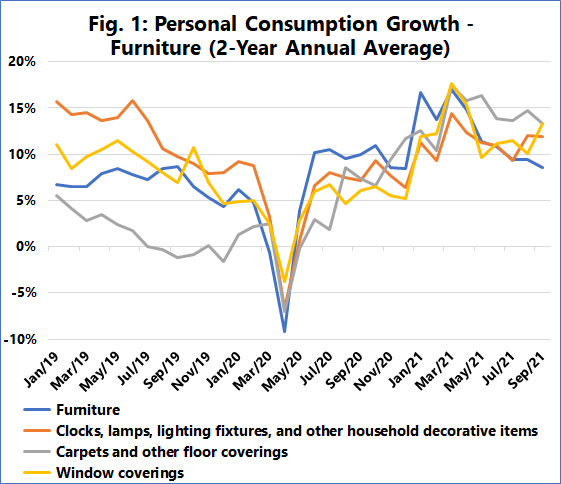

One of the fastest growing subcategories is furniture. Furniture absorbs a significant portion of container volumes and is a major driving force behind the boom in North American import volumes..

The data seems to suggest that furniture spending is a pre-indicator of household consumption in other market segments. According to Sea Intelligence’s press note it appears that the average consumer buys new furniture first and only then, slightly later, purchases carpets, lamps, window accessories, etc.

The boom in consumer spending that has been driving container volumes showed no signs of slowing down in September. Although there was some evidence of decline in the growth rate, this was largely driven by motor vehicles and not by typically containerized consumer products.

According to analysts, we should not expect, in the short to medium term, a drop in demand to solve the congestion problems experienced by U.S. ports.

Translation by Giles Foster