A price war is already raging between the carriers on container freight rates.

Sea Intelligence disclosed this in a report comparing two very similar market situations: the one that emerged at the beginning of 2020, following the outbreak of the new coronavirus epidemic in China, and the current one, which began in September 2022 as a result of the conflict in the Ukraine and the ensuing energy crisis.

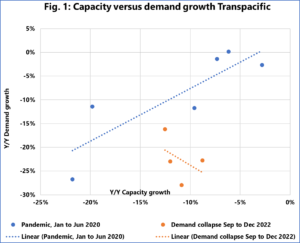

Analyzing the capacity available on the transpacific trade in relation to the rate of reduction in demand, the consultancy firm points out that global carriers behaved differently during the two periods under investigation.

Whereas in 2020, shipping companies were able to curb the collapse in freight rates thanks to a careful policy of managing the vessel capacity available, in 2022 carriers were unable or unwilling to reduce capacity in direct proportion to the collapse in demand. On routes between Asia and Europe, the pattern followed was virtually the same. Why?

According to Alan Murphy, this type of behaviour can be explained in the light of the new market development which is leading carriers to accept lower profit margins in order to adapt to the new downward price trend.

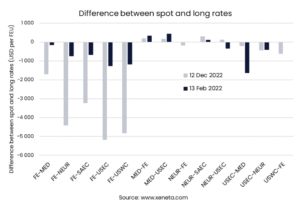

That the situation is changing is also evident from the development of quotations for contracts for transporting containers by sea, which so far are still quite high despite falling tariffs in the spot market.

In the increasingly gloomy environment of ocean container transport, many shippers are successfully renegotiating their contracts with shipping companies, snatching up freight rates whose values today are not far from spot rates.

On the five major trades to and from the Far East, Xeneta estimates that the gap between spot and contract rates is much less than it was two months ago. Today, long-term contract freight rates cost on average $810 more per FEU than spot rates, compared to the $3900 per FEU difference in mid-December.

The biggest drop was in the links between the Far East and the US East Coast. Spot rates are now cheaper by 1280 dollars per FEU but in mid-December it would have taken 5180 dollars per FEU more to sign a long-term contract.

According to Xeneta analysts, as contracts approach their expiry date, the premium for long-term rates is expected to continue to decline. They pointed out that although carriers are trying to protect contract rates, high competition and the possibility for shippers to move to the cheaper spot market has caused them to lower their expectations.

On the main front haul trades, the cheapest long-term contracts are for services between the Far East and the Mediterranean: they cost 150 dollars per FEU more than spot freight rates.

Translation by Giles Foster