Despite China’s strategy to substantially increase domestic coal production, China’s seaborne coal imports have skyrocketed 73% year-on-year.

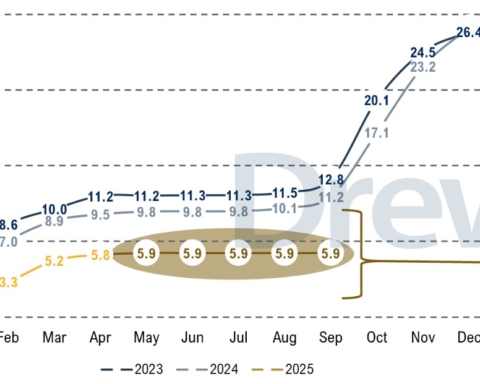

According to BIMCO, one of Beijing’s targets is to increase coal production by 4.6 billion tonnes by 2025, or 2.5% more than 2022. Given that coal production has increased by 5.8% since the beginning of the year, China’s coal mines will reach the target much earlier than expected, even by the end of 2023.

How then can the dramatic increase in seaborne imports of this fossil be explained? According to Bimco’s Chief Shipping Analyst, Niels Rasmussen, the soaring costs of mining and washing coal, +45% in 2021 and +17% in 2022, have prompted China to buy fossil fuel from foreign countries, like Indonesia, (half of Chinese coal imports during the year came from there), while Russia and Australia supplied the other half.

Capesize vessels are the ones that have benefited most from the surge in imports, but the other segments have also benefited from the favourable economic climate.

However, BIMCO points out that imported coal accounted for 7-8% of the total coal supply in China. Together, increased imports and domestic mining have so far boosted China’s total coal supply by over 15% year-on-year. Electricity production from fossil fuels (mainly coal) was up by 5.8% year-on-year, while steel production rose by 2.8% year-on-year.

According to Mr. Rasmussen the gap between increased demand and supply led coal stockpiles in Chinese power plants to reach a record 187 million tonnes in May, more than the total seaborne imports since the beginning of the year. Although, he said, it remains to be seen whether China will continue to build coal stocks, in his opinion “it seems more likely that coal supply will have to adjust to lower coal demand.”

Translation by Giles Foster