“In Italy we talk a lot, maybe too much, about the ‘Green Pass’, but we never talk about China. The energy crisis that has hit Beijing is worrying and could have serious repercussions on the entire supply chain, but apart from a few specialized magazines, no one cares”. Alice Arduini possibly understands better than most the ‘moral implications of distance’, as Carlo Ginzburg put it.

Her long apprenticeship in the international shipping business has led her to experience, perhaps almost continuously, the so-called Mandarin dilemma.

And now that she finds herself having to manage her own freight forwarding company, Alix International – opened in April, in the midst of the post-pandemic crisis – Arduini knows just how ambiguous the maxim attributed to Diderot is: “The assassin, removed to the shores of China, can no longer see the corpse which he left bleeding on the banks of the Seine.”

“What the eye doesn’t see, the heart doesn’t grieve over.” Nothing could be further from the truth, especially in a sector where the flutter of a butterfly’s wings in South America can become a typhoon in Asia. “Chinese imports play a key role in my company,” she says, “and we can’t help but follow with some apprehension what is happening in that country, which is still grappling with serious problems in managing the Pandemic.”

In particular, it’s the energy crisis that concerns the forwarder most: “The extreme electricity shortage caused by the soaring cost of raw materials in the world’s largest exporter is having serious consequences on the supply chain. And the timing couldn’t be worse, at a moment like this, when the shipping industry is dealing with congested supply lines.”

The situation is worrying: “Since the beginning of the week I’ve been receiving alarming phone calls from many of my clients. They’re asking me for a hand: a number of Chinese factories, especially the peripheral ones, are forced to reduce production and turn off their power supplies from 7 pm onwards in order to respect the energy quota policies introduced by the Beijing government.”

Arduini describes what happened to a businesswoman who imports lighting components from China: “She told me that if it normally took 30 days to produce lighting parts, now it takes ninety. So she doesn’t know what to do, or whether to order more goods at the same to get the raw materials she needs.”

China’s energy crisis is leading to a logistical one: “The Chinese New Year is just around the corner and will only worsen an already critical situation. Some clients are groping around in the dark and are calling us forwarders for the support they need, but the situation is getting out of hand”.

Hence, it’s a very delicate scenario for freight forwarders, in a market dominated by the commercial policies implemented by the big carriers in the container sector. “My business with China involves full containers or groupage. Despite the Cold War between the two countries, Beijing and Washington have never had so many commercial ties.”

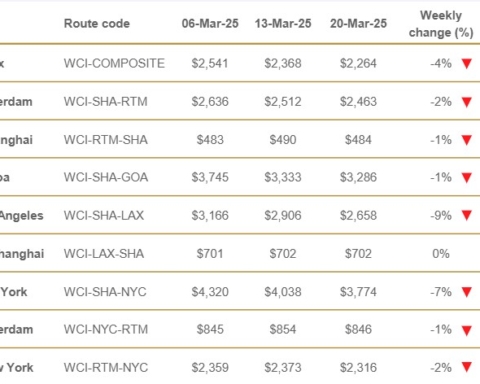

The USA is currently the real center of commercial power: “They are continuing to buy products from Asian Far East markets at a rate that, with the forthcoming Chinese New Year, is becoming unsustainable.” American customers are compulsive shoppers. This leads to new commercial speculations on the most profitable route on the planet: “Shipping a 40 feet container from China to the USA now costs 30.000 dollars, practically double what we pay on the Asia – Northern Europe trade route.”

It’s easy to imagine why shipping lines have decided to concentrate ships and containers on the lucrative Sino-U.S. business, worsening congestion problems in U.S. ports and leaving other trade routes untouched. “Southern Europe has become marginal on the map of carriers’ business interests,” says Arduini, complaining about the increasing difficulty in finding available slots on ships.

Of course, in these cases, being a small forwarder can have its competitive advantages. Alix International has succeeded in snatching away important clients from much more renowned shipping companies because, unlike these, they are not obliged to charge freight costs in Italy: “We charge them directly to the Chinese.” If you have a good agent in China you are able to negotiate a better freight rate and have higher profit margins, also ensuring the shipment of the goods” she points out, adding that the large freight forwarders receive tariff discounts from shipping companies based on the number of TEUs imported, and therefore they are obliged to prove that they ship the goods to Italy with the contract imposed by them. “I don’t have to prove anything. We are not slaves to the U.S. or Chinese subsidiaries or freight negotiation policies.”

Company size apart, the truth is that sooner or later everyone will end up paying for this situation, including final consumers, who will be charged the extra cost of ocean freight and land transport, also due to the increase in fuel prices. “This means our industry will suffer financially. Many companies in Italy have been forced to record a loss of profits because they certainly cannot change their business plans as they go. I know companies that, faced with an increase in costs, have even given up profits in order not to change their price lists which had already been fixed.”

Alice Arduini hopes that at governmental level, international institutions will soon be able to get to grips with the problem of keeping global supply chain intact but doubts that anything will be done before the Chinese New Year. In other words: “There are difficult times ahead. The big carriers will continue to churn out profits while things will become increasingly difficult for shippers and forwarders.”

Translation by Giles Foster