This year, the tariff war could negatively affect, indeed really hurt, the US shipping economy. The traffic forecasts reported a few days ago by Los Angeles Port Authority say this: the failure of the negotiations between China and the USA would have a significant impact on the main west coast port, which, in 2019, could risk losing up to 20% of its market volumes. i.e. 2 million TEUs out of the nearly 10 million handled in 2018 by the North American seaport.This is the treasure that would be squandered if the two contenders, Donald Trump and Xi Jinping, do not manage to reach a definitive truce by March 1, the deadline beyond which on the 200 billion dollars’ worth of imports from China, the extra 10% taxes already in force would be raised to 25%.

Despite the fact that the American president has declared, on more than one occasion, that he does not want the deadlines to be the be–and-end-all, considering possible further extensions of the time limits in the event that the negotiations in progress showed some glimmer of hope. In common terms, ‘worried’, is the adjective that is most fitting for those who try to understand the moods of operators in the US who stagger their way forward, in the midst of announcements of progress and fears of stalemate.

In addition, that ‘20% less traffic’, launched more as a warning, an alarm signal, than an incontrovertible fact, risks becoming the epitaph on the grave of the free market.

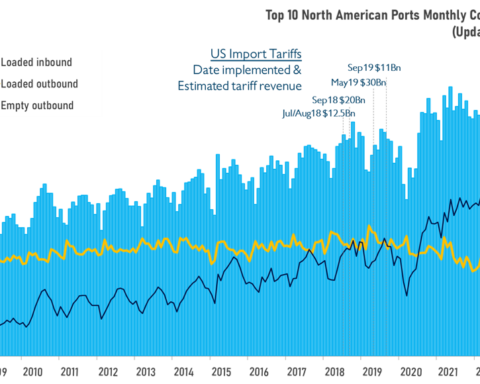

The algorithm of protectionism, however, has an infinite range of modulations. These days U.S. ports are, in fact, suffering from the problem diametrically opposed to the one Los Angeles Port Authority alluded to: they are mostly congested because of the surge in traffic volumes that has been recorded since the charade on the extra-days began. Throughout 2018, shippers have in fact sent shipments of huge amounts of goods in advance to avoid any (but increasingly likely) new increases in tariffs. For months, containers have accumulated, one on top of the other, in specialized terminals, with devastating effects on the operational efficiency of almost all American ports.

It is no coincidence that in 2018, U.S. ports handled a record volume of 21.8 million TEUs, an increase of 6.2% over the previous record of 20.5 million TEUs in 2017. It is one of the most curious aspects of the current tariff war between the two countries: for the moment, protectionism has increased the turnover in the shipping sector, helping to reduce the oversupply situation and to promote a better balance between supply and demand along the transpacific routes.

Shippers are likely to continue shipping high volumes throughout the first quarter of 2019, at least until 1st March this year. But what happens next? Can we expect a shipping gap for the whole of 2019 and a collapse in trade? Hard to answer today.

Drewry expects global demand for containerised transport to grow by 4% this year, slightly down on last year. Moreover, these estimates could well take an even further downward trend.

What the American maritime cluster and potential investors fear most is not terminal congestion, but the uncertainty that has arisen due to the so-called ‘trade war’ between Washington and Beijing. At global level, analysts predict that during the year ports will have to prepare to absorb an additional container capacity of 25 million TEUs, investing a total of 7.5 billion dollars and handling a total of 800 million TEUs. The question arises as to how all these containers will be distributed along the various routes and whether the possible transpacific traffic crisis caused by failed negotiations will not end up benefiting the European markets and the commercial exchanges on transatlantic trade

What is certain is that the U.S. ports are likely to be damaged by too many current uncertainties: the market is extremely receptive, hypersensitive; records in real time any geo-political changes and quickly responds to impetus, continuously redesigning trade flows. The expected increase in freight rates for 2019 and the continuation of the Sino-American trade war weighs heavily on today’s forecasts and risks seriously affecting the future.

Translation by Giles Foster