2021 will be remembered by the big carriers as the year of record profits. Just as we are beginning to see new hope for the near future on the expensive freight rate front, with the main market indexes indicating a return to stability on the spot market, Sea Intelligence reports that, in the third quarter, the shipping companies operating in the container transport sector recorded a combined operating profit of 37.2 billion dollars. This result brings the total profit of the last nine months to 80 billion dollars.

The sector’s performance was driven by the high sea freight rates charged by the big companies, which in most cases reached new historic peaks between August and September. The average freight rate applied by Maersk, for example, reached 3,561 dollars per FEU, up 86.5% on the same period of the previous year.

CMA CGM’s reported increase in revenue – to $15.32 billion, up 89.4% over the same period in 2020 – is also largely attributable to record revenue generated by its containerized shipping business (+101.3%).

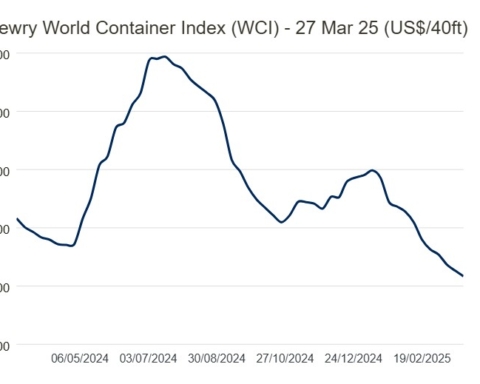

As many analysts have pointed out, the continuous pressure on the effective shipping capacity for consumer goods observed since the summer of 2020 should allow liners to perform well financially during the fourth quarter as well. It is a fact, however, that globally, container freight rates are continuing, albeit tentatively, to fall.

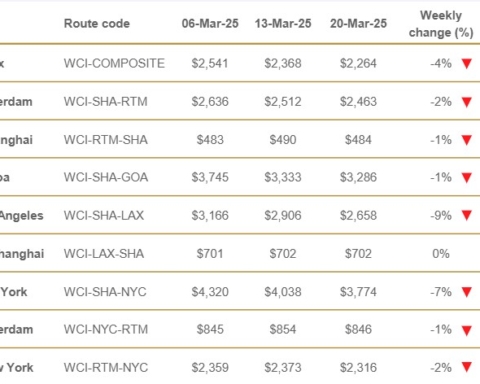

Last week’s data shows how the World Container composite index remained steady at $9,186.39 per 40-foot container, a figure that remains 224% higher than the same period last year.

Only the Rotterdam-New York route saw a drop in the cost of container shipments, registering a 1% downturn last week to $6,232 per FEU. All other trades were stable, with the exception of the Shanghai-Rotterdam and Shanghai-New York routes, both up 1% to $13,475 and $13,2390 per FEU respectively.

Spot rates are expected to decline further in the coming weeks but there could be a significant increase in long-term contract prices.

Shippers, both American and European, are in fact moving in view of the Chinese New Year. They are entering into new negotiations to sign important medium-long term contracts for significant volumes of goods. This is an operation that, in principle, allows shippers to block the price of a shipment and, above all, to secure the reservation of available slots on board ship.

The risk of being left behind, in fact, is very high, especially in times like these, characterized by continuous emergencies and interruptions to the logistics chain. Better, therefore, to stipulate long-term contracts, even if onerous. This is the basic strategy that could allow carriers to record solid profits for 2022 as well.

“Annual contracts signed in 2020 are very low compared to current spot freight rate levels,” an Italian freight forwarder who preferred to remain anonymous told Port News. “Although many of the contracts were tweaked upward during the first half of 2021, especially those without guaranteed allocation, the companies have every interest in securing more advantageous long-term contracts, however.”

Even in the presence of a new wave of downturns in the spot market and a normalization of the availability of cargo space, with 12% of the total currently unused, carriers could be in a position to toast to a new year of success.

Translation by Giles Foster