According to Sea Intelligence’s analysis, based on the latest data published by the US Census Bureau, US retailers are continuing to boost their stocks. A cautious attitude, dictated, perhaps, by growing concerns about the negative effects that the new trade war could have on business with China and the other countries that Trump has announced he wants to hit to restabilize commerce.

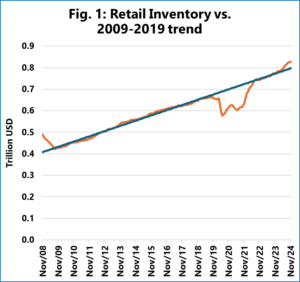

The UK analyst firm shows that, as of November 2024, stockpiles reached levels that are $30.2 billion above the normal retail inventory growth trend, represented by the blue line in Figure 1 (the one showing the trend over the period 2009-2019).

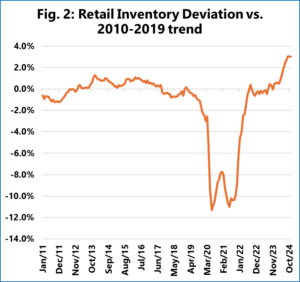

The UK consultancy firm also questions how far current retail stocks have actually deviated from the trend that has been developing since 2011, when most of the post-financial crisis effects had disappeared.

Figure 2 shows that the upward peak in the July-August 2024 period represents the largest upward shift ever recorded since the financial crisis.The top month was September 2024 with a 3.1% extra but in October and November this percentage fell only marginally to 3.0%. It would therefore be fair to say that retailers have been stockpiling and they are continuing to do so even now.

“For some retailers, inventory buildup may be a hedge against coming tariffs. On the other hand, a potential implication is that if consumer spending suddenly is reduced due to the inflationary effect of tariffs, the retailers might well have excess inventory on their hands,’” explains Sea Int. CEO Alan Murphy

Translation by Giles Foster